Taxes. The smallest word that often causes the most confusion for anyone and even more for business owners.

Restaurants, in particular, have complex tax laws. Your taxes depend on many various factors; location, property size, number of employees, and most importantly, revenue.

Right now, restaurants are critically thinking about their bottom line as they prepare for the loss in sales due to closures or limited operations.

Since it’s tax season, operators are left searching for new ways to save money on their taxes. So, to help, we’ve gathered the essential things you need to know to maximize your restaurant’s tax deductions and credits.

Use these resources to help guide you for more information on filing taxes:

- Tax time guide: how to do taxes for free and get refunds fast from the Internal Revenue Service (IRS)

- Small business income tax guide

- Corporate income tax guide

- Guide for business taxes for partnerships

Tax deductions for restaurant owners

What is a tax deduction? A tax deduction is an expense that lowers a person or business’s tax liability by reducing their taxable income.

Expenses accrue over the year and can be applied against or subtracted from your gross income to figure out how much tax you owe.

All deductions must be deemed ordinary and necessary business expenses.

Here are some of the expenses that you can deduct when filing your income tax return with the IRS:

Food costs

The first and one of the most significant expenses, along with labor, is food.

Food costs can include raw ingredients, canned food purchases, spices, oil, etc. The cost of food can also include spoiled food that goes to waste and cannot be served.

Refreshments like soda, bottled water, liquor, beer, juices, milk, etc., are also part of food costs.

Labor costs

Another major expense in a restaurant is the labor of your employees. This includes your front and back-of-the-house staff and managers. You can deduct gross wages and employment taxes that you pay based on employee work and tips like unemployment, Social Security, and Medicare taxes.

You can also include benefits such as sick leave, retirement accounts, insurance, and vacation.

Utensils & table items

Anything that is used for guests to eat can also be a deduction. These supplies can be glassware, plates, condiments, napkins, menus, to-go boxes, etc.

Capital expenses

These expenses include kitchen equipment, tables, chairs, and improvements to the building.

If you own a vehicle for your restaurants, such as a catering or delivery car, it’s also a capital expense.

Capital expenses have a longer life of more than one year, so you must set them up as business assets. This is to prevent them from being written off in total in one year.

The IRS does set limitations to how much of each class of assets can be expensed each year.

Fees & insurance

Any fee you have such as:

- Professional fees – accounting, lawyers, contractors

- Banking fees

- Software fees – like your cloud-based POS station and software-as-a-service (SaaS) applications

You can also deduct property and liability insurance, along with other policies used to protect your restaurant location, employees, and customers.

Marketing & advertising costs

Write off any marketing that you have paid for, including but not limited to:

- Social media advertising

- Promotions

- Google AdWords

- Coupons

Tax credits to take advantage of now

According to Restaurant365, “A tax credit is a direct reduction in your tax liability. A tax credit is an incentive to entice businesses to conduct certain hiring and/or investment activities such as:

- Hiring individuals from certain groups that face high employment

- Hiring or investing in economically disadvantaged areas

- Investing in a particular activity

- Retaining employees after natural disasters and other events.”

Here are 3 of the tax credits you need to know about:

#1) Employee retention tax credit

Eligible restaurants can access the Employee Retention Tax Credit (ERTC) for both 2020 and 2021 to receive economic relief in the form of tax credits for qualified employee wages. These specific payroll wages are only eligible if they were not directly paid for by PPP loan funds.

#2) FICA tip credit

The FICA tip credit, specifically aimed at restaurant owners, is a federal tax credit that potentially reduces their tax liability. It’s linked to the Social Security and Medicare taxes owners pay on employee tips. Essentially, if employees receive tips directly from customers, a portion of those tips can be counted as a credit towards the employer’s share of FICA taxes.

This FICA tax credit has been available to the employers in the food and beverage industry since 1993. Learn more about how it works here.

#3) Work opportunity tax credit

Another tax credit you can benefit from is the Work Opportunity Tax Credit (WOTC). WOTC is a federal tax credit available to employers hiring people from certain qualified groups of people who face employment barriers.

The WOTC has been authorized until December 31, 2025.

Find more information on WOTC targeted groups and requirements for this credit from the IRS here.

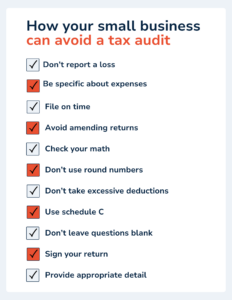

Tips on how to avoid a tax audit

It’s important to note that restaurants are frequent targets for tax audits.

Why? Many owners don’t file taxes by the due date, don’t keep a record of income, or reports of income don’t match statements.

Source: LegalZoom

In addition, here are five tips on how to avoid an audit from the author of Restaurant Tax Solutions, Robert Boeshaar:

- File your taxes on time. The tax-filing deadline for this year is April 15, 2024.

- Work with tax professionals to avoid making mathematical errors. It’s better to pay somebody and get it right the first time versus paying more in costly mistakes.

- You must report all your income. Failing to report all your taxable income, especially intentionally, can lead to severe issues. Keep a report of all the income the restaurant receives, and don’t forget to include tips!

- Don’t make invalid or excessive deductions. Though there are many deductions available, make sure the ones you use are valid, and you can back up.

- Classify your workers correctly. Failure to do this can lead to a lot of trouble. You are required to withhold payroll taxes and issue W-2 forms to your employees. Some restaurants try to classify workers as independent contractors to avoid doing this, leading to hefty fines.

The ultimate recipe for success

CAKE and DAVO Sales Tax have joined forces, creating a seamless experience for business owners. DAVO takes the stress out of sales tax management, ensuring funds are set aside, and payments are never missed. With just a quick 5-minute setup, this partnership empowers entrepreneurs to focus on what truly matters – perfecting their craft and delighting customers with every slice of cake.

The bottom line

Being a restaurant owner isn’t a cheap endeavor, so you must do your research to reduce your tax liability.

Get help from your tax advisor and go over the deductions and credits above to see if they can help minimize what you owe this tax season.

Disclaimer: This content is intended for informational purposes only and should not be relied on for tax, legal, or accounting advice. You should consult with your tax advisor, and you are responsible for your own compliance with laws and regulations.